Retirement Funds Newsletter – June 2017

IBEW Local 25 Funds Update

U.S. stocks gained through April 2017 amid strong U.S. economic news, while non – U.S. developed and emerging markets stocks gained amid a weaker dollar, signs of growth in Europe, and lessening concerns about U.S. trade policy. Bond returns were modestly positive amid continued low interest rates and the Federal Reserve’s decision to raise its policy interest rate in March.

In this environment, the IBEW Local 25 Pension, Annuity and 401(k) Funds generated preliminary returns of 4.4%, 3.2% and 3.6%, respectively, for the April 2017 year-to-date period. Preliminary annualized returns for five-year, three-year and year-to-date periods through April 2017 are summarized below.* Please keep in mind that these returns do not take into account the Funds’ administrative/operating costs.

IBEW Local 25 Retirement Funds’ Returns through April 30, 2017*

|

Fund |

5 Yrs. |

3 Yrs. |

YTD |

| Pension |

8.3% |

5.8% |

4.4% |

| Index |

7.7% |

6.0% |

4.3% |

| Annuity |

5.8% |

4.2% |

3.2% |

| Index |

5.3% |

4.3% |

2.9% |

| 401(k) |

5.9% |

4.2% |

3.6% |

| Index |

5.3% |

4.2% |

3.0% |

*Returns are preliminary. Returns for periods prior to September 2014 include certain fees.

April 2017 Market Review

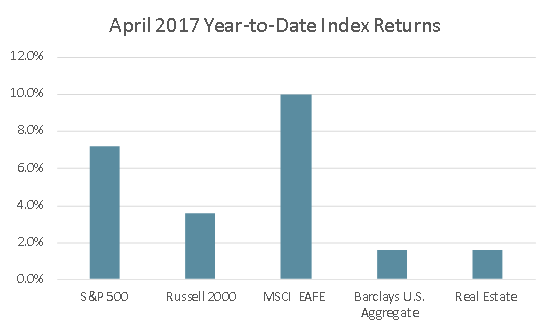

April 2017 year-to-date returns for equity indexes ranged from 3.6% for the Russell 2000 Index of small U.S. company stocks, to 7.2% for the S&P 500 Index of U.S. large company stocks and 13.9% for the MSCI Index of Emerging Markets Stocks. The Barclays U.S. Aggregate bond index gained 1.6% amid anticipation of future Federal Reserve interest rate hikes in 2017. Global and U.S. high yield bond indexes returned 2.9% and 3.9%, respectively, through April 2017. Among alternative investments, U.S. real estate gained 1.6% in the first quarter, while Commodities, as measured by the Bloomberg index, lost 3.8% through April amid concerns of an oversupply of oil. Hedge funds gained 3.0% for the year-to-date period.

Figure 2: April 2017 Index Returns

May 2017 Update

Global equity markets continued their upward trajectory in May as mostly positive news about the U.S. economy, optimism about corporate earnings and the election of a centrist candidate in France offset concerns about high equity valuations and potential obstacles to the U.S. administration’s legislative agenda. U.S. fixed income markets also advanced as investors appeared to be taking the prospect of rising interest rates in stride. With the notable exception of U.S. small cap stocks, which gave back a portion of their gains, most equity indexes and bond indexes added to their gains in May. For the May 2017 year-to-date period equity returns ranged from 1.5% for the Russell 2000 index to 17.3% for the MSCI Emerging Markets index. The Barclays U.S. Aggregate Index gained 2.4% through May.

Risk Management

Risk may generally be defined as the chance of something happening that will impact an organization’s ability to achieve its objectives. By breaking risk into categories, such as market, operational, credit and asset/liability risk, an institutional investor can assign measures to each risk, while assigning responsibility for managing it. The goal is to reduce the probability and severity of negative events with the understanding that an investor, such as a retirement fund organization, must assume some level of risk to achieve its return objectives.

Institutional investors generally document a framework for managing risk in policies, contracts and other governing documents. Consistent with this, the IBEW Local 25 Retirement Funds operate under separate investment policies that set thresholds for the amount of market risk the Funds may take, while delegating responsibility for day-to-day management of certain risks to service providers, investment managers and advisors. The saying “if you can’t measure it, you can’t manage it,” very much applies to retirement funds. To that end, the IBEW 25 Retirement Funds review reports that include key risk measures along with other characteristics. These reports provide a basis for monitoring as well as corrective action. The IBEW Local 25 Retirement Fund Trustees will continue to work with their investment consultant, advisors and staff to oversee risk, while positioning the Funds to meet their long-term investment objectives.